Effects of tobacco taxes on income distribution in Argentina

By Guillermo Cruces, Guillermo Falcone and Jorge Puig with support from the Tobacconomics project of the University of Illinois in Chicago (UIC) / March-2020 /

CEDLAS researchers Guillermo Cruces, Guillermo Falcone and Jorge Puig conducted in January this research with support from the Tobacconomics project of the University of Illinois in Chicago. For more information, you can download the full report in Spanish and English, and the brief policy report in Spanish and English.

Main Points

- Tobacco taxes benefit the poor and young people as well as generate more public revenues.

- Over the long term, higher taxes on tobacco result in the generation of higher individual income, enhanced well-being and living conditions, especially among the poorest sectors of society. This is because tax increases reduce tobacco consumption, and the reduction is relatively larger among low-income households.

- In 2015, diseases related to tobacco represented a direct cost of around 0.75% of the GDP in Argentina. Put in perspective, that nation dedicated 0.5% of its GDP to the Asignación Universal del Hijo (Universal Child Allowance) program, its largest income transfer program dedicated to fighting poverty (UNICEF, 2017).

- Traditionally, analyses of the impact of tobacco taxes have only taken into consideration the burden of the taxes on household resources; they have not examined the indirect effects of higher taxes. This research incorporates indirect effects and finds the following:

- Reduced consumption of tobacco products results in better health, lower medical expenses, longer life expectancy and more time for income-generating activities.

- Faced with a tax increase that results in a 20 percent increase in the price of cigarettes, the poorest decile of households would save 4 percentage points of their income; these savings are derived primarily from decreased medical expenses and higher labor income.

- Young people (ages 15-24) are the most impacted by a change in the price of cigarettes. Duplicating the price of a pack of cigarettes reduces the number of smokers in the overall population by 3%, but among this age group the reduction is 6.5%.

Tobacco use represents a major obstacle to development for countries around the world. In addition to being the leading cause of preventable death, smoking-related diseases cost billions of dollars every year. They impose high economic costs in terms of direct medical care as well as losses in productivity (WHO 2015b).[1] Increasing the tax on tobacco is considered one of the most effective methods of removing this obstacle. When the higher tax leads smokers to reduce consumption or quit smoking, their health improves. Even when the tax does not result in a change in behavior and individuals continue to smoke, the government has a strong and justifiable source of income.

A common objection to tobacco taxes is that they tend to fall disproportionately on lower income families, as these households usually allocate a significantly higher proportion of their income to tobacco spending. This objection is grounded in at least two faulty assumptions: i) that all individuals throughout the income distribution react similarly to an increase in the price of cigarettes (caused by tax increases); and ii) that changes in tobacco taxation affect households only through the expenditure on tobacco. First, lower-income individuals are more sensitive to changes in cigarette prices—that is, they have a higher price elasticity for demand. As a result, price increases have a higher relative impact on their tobacco use, generating changes in consumption patterns throughout the income distribution. Secondly, tobacco taxes can affect household spending beyond tobacco expenditures itself. In particular, if a tax discourages consumption, households can expect to save on future medical expenses associated with smoking-related diseases; [2] they will also have more years in the labor workforce, given their longer life expectancy.[3] As lower-income households consume relatively more tobacco, savings in medical expenses and increases in future labor income will be relatively greater for them (Fuchs and Meneses, 2017).

In this CEDLAS investigation, data from Argentina’s National Survey of Household Expenditures conducted between 2004 and 2005 (ENGHo 2004/2005) is used to estimate the distributive incidence of changes in tobacco taxes. The study estimates differential price elasticities of demand for cigarettes by income level, and also considers the fact that changes in the price of tobacco products can generate indirect effects. These effects have an impact on the individuals’ budgets, particularly by reducing their projected medical expenses in treatments of smoking-related diseases and increasing their income due to a lowered risk of premature death.

Results of research

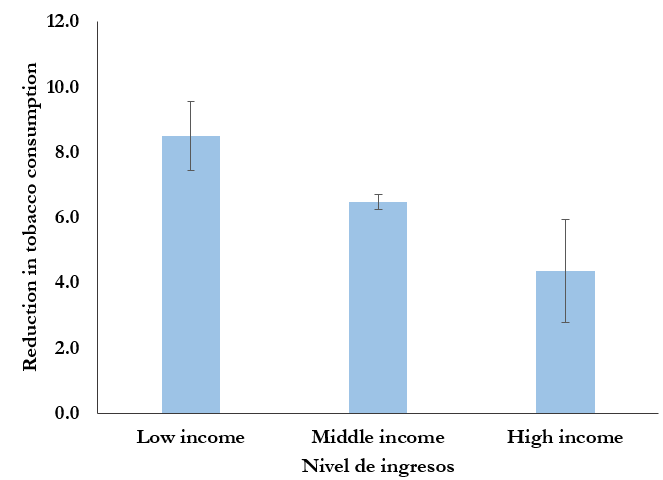

The results indicate an important difference in individuals’ sensitivities to an increase in cigarette prices. Figure 1 shows that lower-income consumers have higher price elasticities of demand for cigarettes, in absolute value. Specifically, the price elasticity for a person with the overall average income in Argentina is -0.65, as compared to -0.85 for an individual with the average income of the lowest decile, and -0.44 for one person with the average income of the highest decile. Considering these results, a 10% increase in the price of cigarettes would decrease consumption by 8.5% (4.4%) for the poorest (richest) smokers.

Figure 1. Estimation of price elasticities of demand for cigarettes in Argentina. By income level. Based on the National Household Expenditure Survey (ENGHo 2004/2005).

Source: ENGHo 2004/2005, INDEC. Error bars represent a 90% confidence interval.

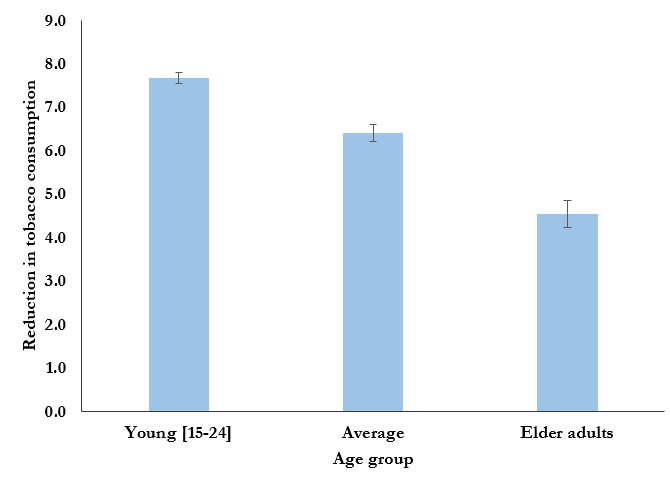

This research also finds differences in price elasticities among age groups. Young people (15-24 years) are the most sensitive to changes in the price of cigarettes. Doubling the price of a pack of cigarettes would reduce the number of smokers overall by approximately 3%, but the greatest response would be found among young people, 6.5% of whom would quit smoking (Figure 2).

Figure 2. Estimation of price elasticities of demand for cigarettes in Argentina. By age groups. Based on the National Household Expenditure Survey (ENGHOo 2004/2005).

Source: ENGHo 2004/2005, INDEC. Error bars represent a 90% confidence interval.

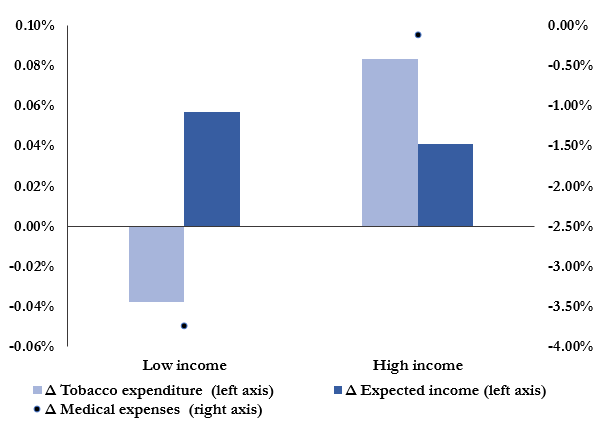

Figure 3. Effects of an increase in cigarette prices on income distribution in Argentina. Direct and indirect effects. Change in percentages.

Source: Authors’ own elaboration based on ENGHo 2004/2005 and Alcaraz, Caporale, Bardach, Augustovski and Pichon-Riviere (2016)

The results also suggest that, by including indirect effects and considering heterogeneity in individuals’ sensitivities to price changes, an increase in the price of cigarettes improves income distribution. The main mechanism behind this result is the considerable savings in medical expenses experienced by lower-income individuals (Figure 3).

POLICY RECOMMENDATIONS

These findings suggest that increases in tobacco taxes in recent years in Argentina improved the well-being of the population, especially for poorer households and younger individuals. Higher tobacco taxes can generate greater income, enhance well-being and improve living conditions over the long term, especially for the poorest individuals. This is because higher taxes reduce the consumption of tobacco products, and this reductions is relatively larger for lower income households. Reduced consumption of tobacco results in better health, lower medical expenses, longer life expectancy, and more time for income-generating activities. The results of this research also indicate that policies that increase the price of cigarettes and other tobacco products should continue. Argentina could surpass the World Health Organization’s recommendations and become a pioneer in applying high tax rates on tobacco in a developing country. This research provides strong evidence on the positive redistributive effects of tobacco taxation, while also illustrating its impact on health and productivity.

[1] According to the World Health Organization (WHO) one in ten deaths worldwide can be attributed to the use of tobacco (WHO, 2017).

[2] In the year 2015, tobacco-related diseases represented a direct annual cost of approximately 89 billion pesos—of which 37% are attributable to smoking—equivalent to approximately 0.75 points of the Gross Domestic Product (GDP). To consider this value in context, in 2016, Argentina allocated around 0.52 GDP points to its most important unconditional transfer program dedicated to the fight against poverty, the Asignación Universal por Hijo (Universal Child Allowance) (UNICEF, 2017).

[3] Alcaraz et al. (2016) also estimate that approximately 884 thousand years of life are lost in Argentina per year due to tobacco consumption.

___________________________

It is allowed to reproduce this blog post, but it is requested to quote the source: Guillermo Cruces, Guillermo Falcone and Jorge Puig in collaboration with UIC (March-2020). Effects of tobacco taxes on income distribution in Argentina. Blog del CEDLAS, https://www.cedlas.econo.unlp.edu.ar/wp/efectos-de-los-impuestos-al-tabaco-sobre-la-distribucion-del-ingreso-en-argentina