El impacto macroeconómico de mayores impuestos al tabaco en Argentina

By Guillermo Cruces, Martin Cicowiez, Guillermo Falcone & Jorge Puig / June-2021 /

Increases in tobacco taxation reduce the consumption of tobacco products and improve health outcomes. Substantial increases in tobacco taxes can even increase aggregate employment in the medium term. The results from CEDLAS’s computable general equilibrium model for Argentina show that a simulated substantial increase in tobacco taxation induces a zero-net change in overall employment in the economy. Increased tobacco taxes may shift jobs from tobacco-related sectors to other sectors of the economy, but the overall impact on the total number of jobs is negligible.

Governments can mitigate and even reverse any adverse employment effects of increased tobacco taxes by devoting the additional tax revenue to increase expenditure on social services and infrastructure. This study indicates that any negative effects on sectoral employment are greatly reduced or even offset when the government uses the additional tax resources to increase spending on labor-intensive sectors such as education, health, and productive public investment.

The overall positive effects of increases in tobacco taxation can be partially allocated to accompanying policies to ease the transition to other activities of those negatively affected by these measures. Such policies include the implementation and extension of rural development programs to cover farmers’ transition costs, training for displaced workers in alternative sectors, a re-direction of newly raised (or existing) tax revenues to alternative crops through agriculture extension services, and other forms of industrial production.

Context

Tobacco consumption imposes many different types of costs (including health, and labor productivity). The most effective and cost-effective policy to reduce tobacco consumption is to increase tobacco taxes. Through them, governments discourage.

Tobacco consumption and promote a healthier and more productive population. Critics of tobacco tax increases, however, often invoke potential detrimental effects on employment because of reduced tobacco sales. This Policy Brief analyzes this myth using a general equilibrium model that simulates the effect of increasing tobacco taxes on key macroeconomic variables.

Results

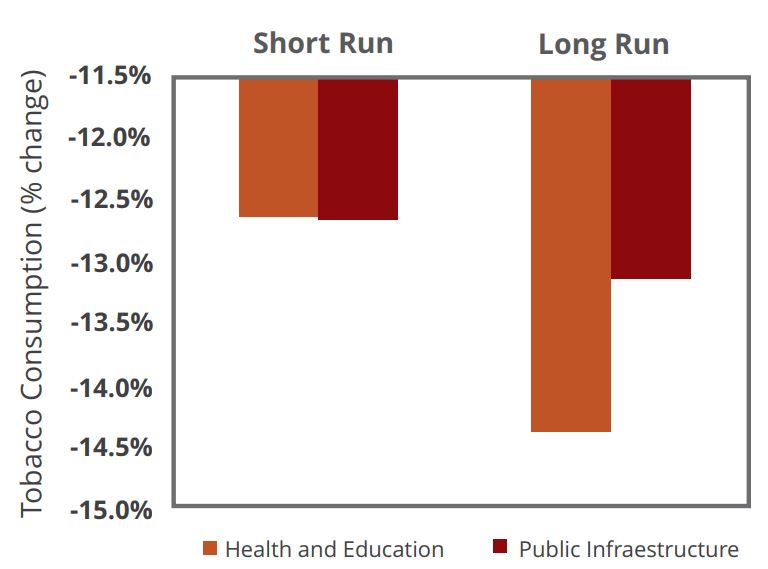

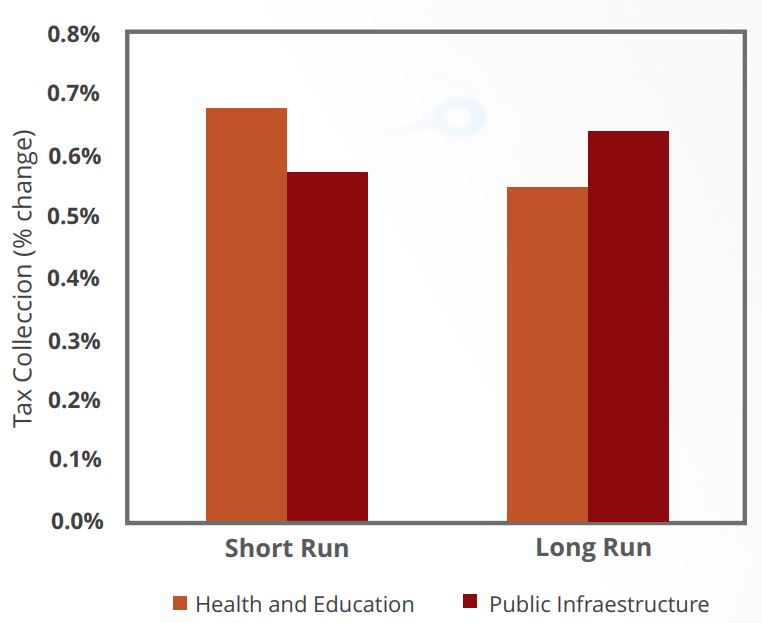

The general equilibrium model results of CEDLAS (2021) show that the increase in tobacco taxes results in higher cigarette prices, decreased cigarette consumption and increases in tobacco tax revenues. A 15 percentage points increase in tobacco taxation in Argentina increases cigarettes prices by about 39.0 percent and decreases cigarette consumption by about 12.7 percent (Figure 1). This reduction represents approximately 218 million cigarette packs in the short term. To put this in context, around 150 million packs of cigarettes are consumed monthly in Argentina. Despite the decrease in consumption, tobacco tax collection increases by around 60 percent, and overall revenue collection increases by around 0.7 percent (Figure 2).

Figure 1. Cigarette consumption: Change in total sales against a 15 percentage points increase in tobacco tax.

Source: Own elaboration based on data from the Ministry of Production and Labor’s Employment Observatory, and Ministry of Agriculture of Argentina. Note: short run indicates effects for 2021 while long run indicates effects for 2025.

Figure 2. Change in total tax collection against a 15 percentage points increase in tobacco tax.

Source: Own elaboration. Note: short run indicates effects for 2021 while long run indicates effects for 2025.

The reduction in consumption of tobacco products decreases the employment in some sectors, including tobacco-related sectors, but importantly at the same time, changes in household spending increase employment in other sectors, resulting in only small changes in overall employment. Moreover, depending on how the government uses the higher revenues it can result in a zero-net change on the overall employment of the economy when the newly raised tax revenues are spent on education, health, and/or public infrastructure. For instance, if the government invests the new tax revenue in public investment spending, there will be a net employment increase of 787 jobs in 2025 (from about 20.5 million employed individuals in the baseline year, 2020). This is close to a zero-net change in employment, as it represents a 0.004 percent increase in jobs that would not have existed without the tax.

Conclusion and Policy Recommendations

Widely documented positive effects of higher tobacco taxes (such as a healthier population, more productive workers, savings in the costs of treatment of tobacco-related diseases, reductions in the number of new young smokers, among others) far out-weigh the nearly null effect of higher taxes on total net employment.

- Increasing tobacco taxes is an effective tool to reduce tobacco consumption with positive effects on health and revenue collection, and with relatively no impact on employment or other key macroeconomic variables.

- If the goal is to increase aggregate employment, revenues from higher tobacco taxes can be allocated to highly productive sectors in the economy.

- If government has concerns on the sectorial impact of tobacco taxes, decision makers can also mitigate and even reverse any adverse employment effects by devoting the additional tax revenue to increase expenditure on social services and infrastructure.

- The overall positive effects of increases in tobacco taxation can be partially allocated to accompanying policies to ease the transition to other activities of those negatively affected by these measures.

___________________________

References

– Cruces Guillermo, Martin Cicowiez, Guillermo Falcone & Jorge Puig (2021). Incidence of Tobacco Taxation in Argentina: Employment and economywide effects. Research report, CEDLAS

___________________________

Se permite reproducir esta entrada de blog, pero se solicita citar la fuente: CEDLAS-UNLP, (junio-2021). El impacto macroeconómico de mayores impuestos al tabaco en Argentina, Blog del CEDLAS, http://https://www.cedlas.econo.unlp.edu.ar/wp/el-impacto-macroeconomico-de-mayores-impuestos-al-tabaco-en-argentina